tax on forex trading ireland

Introduction to Spread Betting. Therefore individuals that are trading in cryptocurrency are required to file an income tax return Form 11 or Form 12 each year and declare profits made on trading.

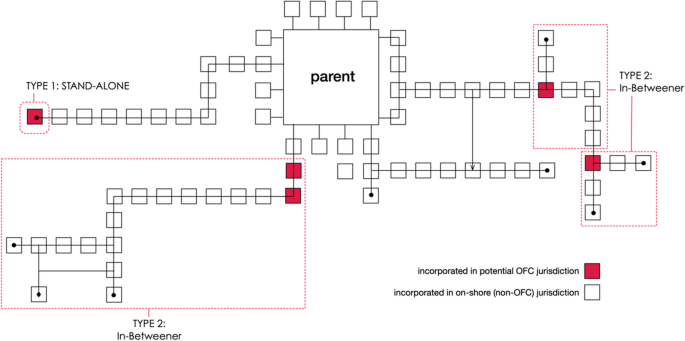

Group Subsidiaries Tax Minimization And Offshore Financial Centres Mapping Organizational Structures To Establish The In Betweener Advantage Springerlink

Forex trading offers Irish the opportunity to invest in the worlds largest liquid market.

. Under s79 TCA 1997 exchange gains and losses arising on the above items are brought into the computation of the companys Case I trading income for corporation tax. By this 6040 tax treatment the traders or the individuals are highly profitable. Forex traders found liable to personal taxation on their trading profits in the UK.

These individuals are only liable to income tax if their income is above a specified limit. Usefully there is a tax-free allowance of 11700 per year for UK based investors. Income Tax rates are currently 20 and 40.

It is completely safe and 100 legal to for any Ireland to trade Forex. So if you keep EURUSD for one year and make a profit you need to pay long term capital gains. Under Section 28 capital gains tax is charged in respect of chargeable gains accruing to a person on the disposal of assets.

13 Capital Gains Tax CGT on chargeable gains individuals CGT is a tax on gains that arise on the disposal of assets such as land buildings shares and crypto-assets. However trading losses computed for tax purposes may be offset on. Under Section 532 any currency other than the euro is an asset for.

Aspiring forex traders might want to consider tax implications before getting started. Forex futures and options are 1256 contracts and taxed using the 6040 rule with 60. This CGT allowance usually increases each year.

The guidance deals with traders and non-traders and youve got to remember that its not a slam dunk that a company will be regarded as trading and thereby chargeable to tax. The concept of fiscal unity or consolidated group tax does not exist in Ireland. This is not an.

You should get to know how the taxes will be calculated in the forex trading when you get to know. Are taxed on the basis of their applicable income tax rates or capital gains tax. Every Ireland Forex broker listed in our top 5 is regulated by an authority such as the Central Bank of Ireland and is.

Capital Gains Tax will arise on CFD Gains. If you trade CFDs then you are subject to capital gains tax CGT on gains from your trading activities. CFDs are liable to capital gains tax.

Income Tax will arise on deposit. EToro income will also be subject to Universal Social Charge USC. USC is tax payable on an individuals total income.

Spread betting or spread trading as it is commonly referred to in Ireland offers a tax-free and efficient way of trading the price movements of thousands of. Long-term capital gains tax represents tax that pays traders who hold assets for more than 1 year. It is easy to invest in Forex in Ireland if you have the ability to own your emotional and financial stress.

Tax on interest earned from a forex trading account Interest earned on forex trading accounts during a given tax year will be added to other interest income if any. Corporate - Group taxation. Capital Gains Tax will arise on the difference between opening and closing values of an asset.

CGT is 10 for basic rate taxpayers when total income is 12571 to 50270. Here you can converse about trading ideas strategies trading psychology and nearly everything in between. For 2022 the specified limit is EUR 18000 for an individual who is singlewidowed and.

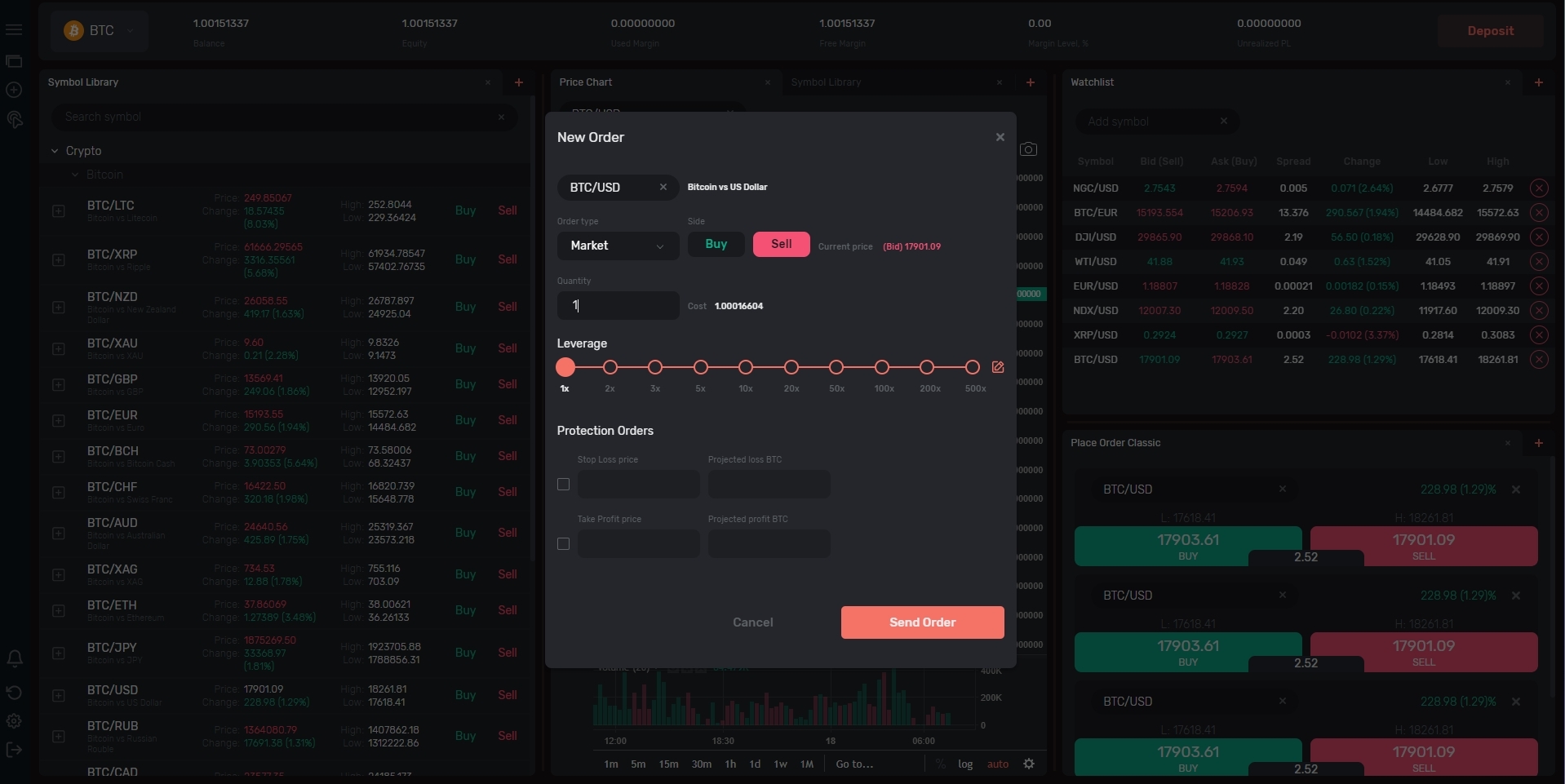

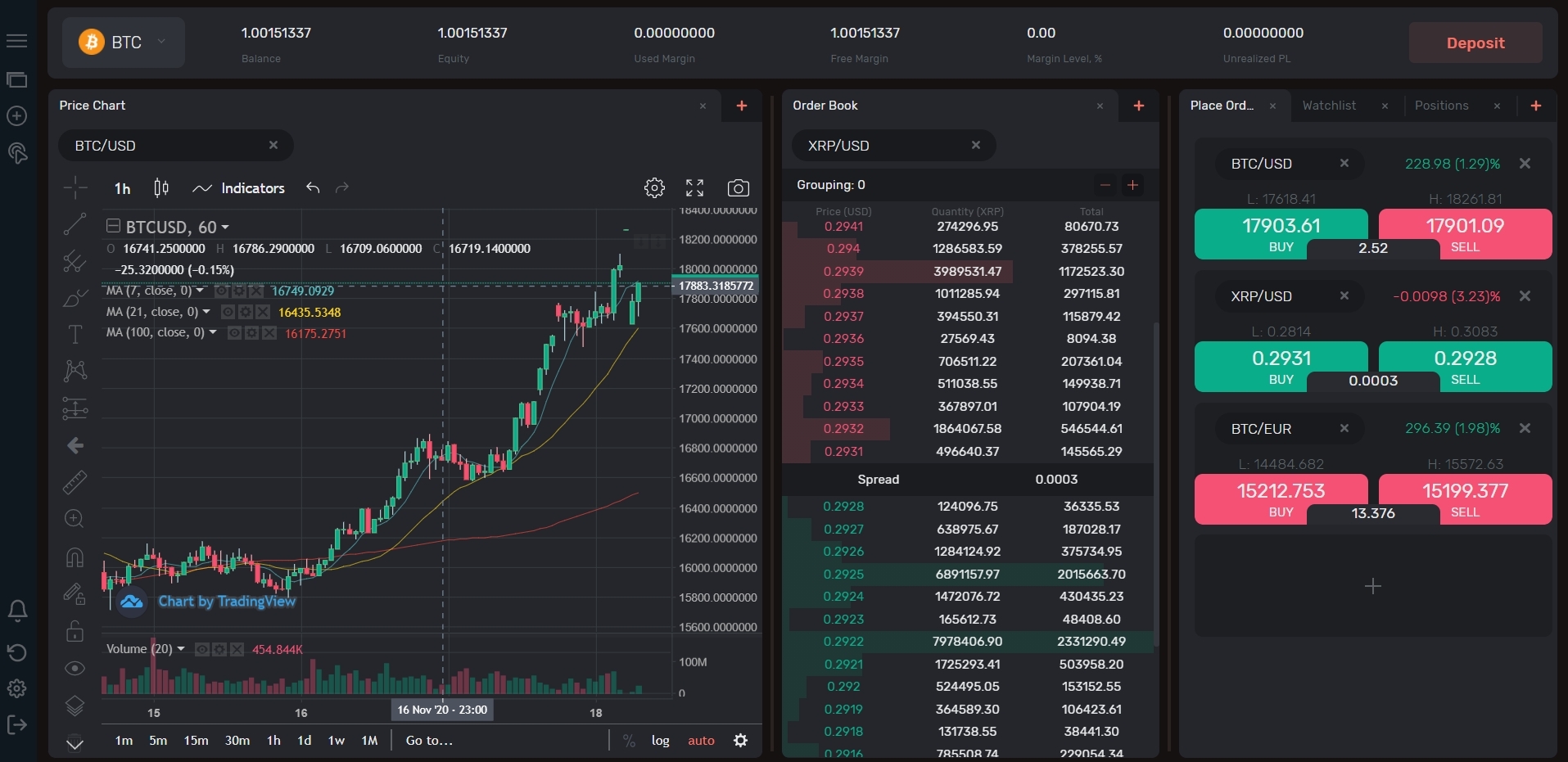

B2broker Launches B2margin White Label Margin Exchange Trading Platform Business Wire

The Latest Progress Of China S Property Tax Reform

The Latest Progress Of China S Property Tax Reform

B2broker Launches B2margin White Label Margin Exchange Trading Platform Business Wire

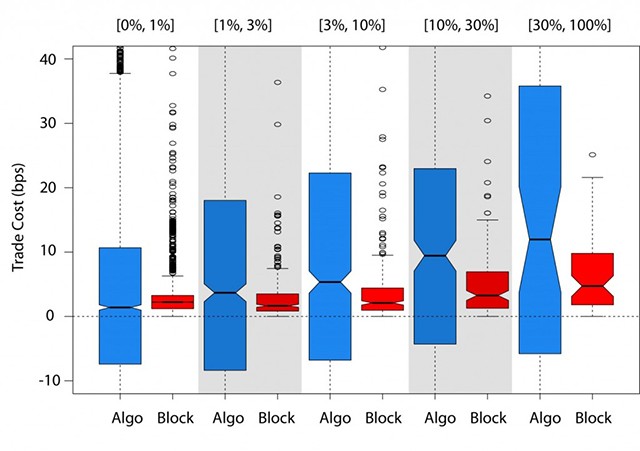

Etf Algorithmic Trading Vs Block Trading Part 3 Bloomberg Professional Services

B2broker Launches B2margin White Label Margin Exchange Trading Platform Business Wire

Verotuspaatosvaliokunta Aanestys Suosituksista Ajankohtaista Euroopan Parlamentti World Economic Forum Map Europe Map

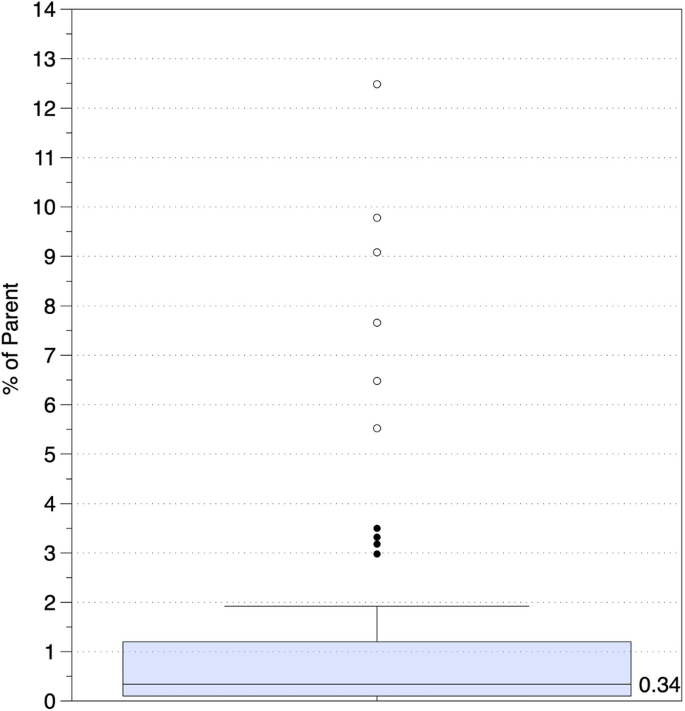

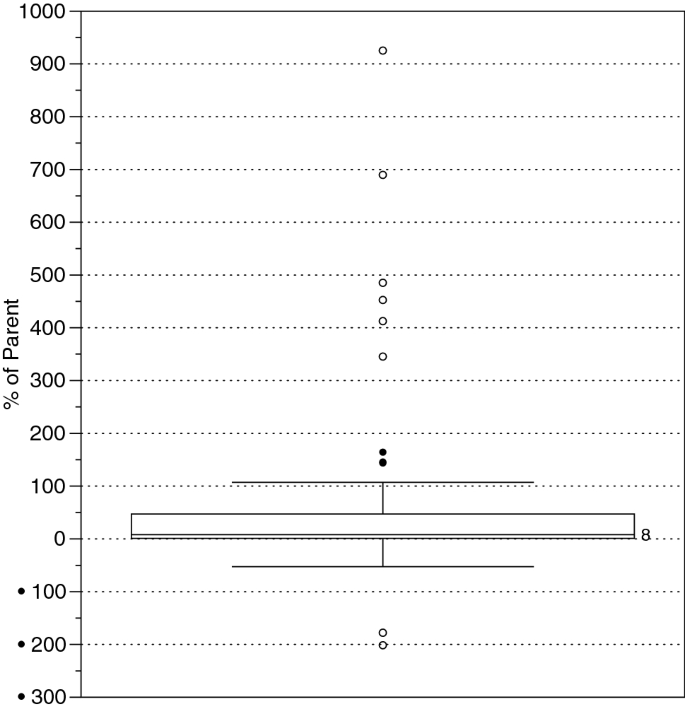

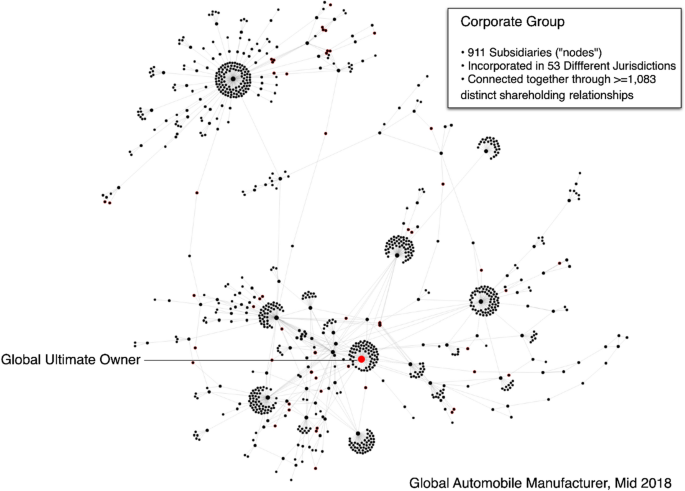

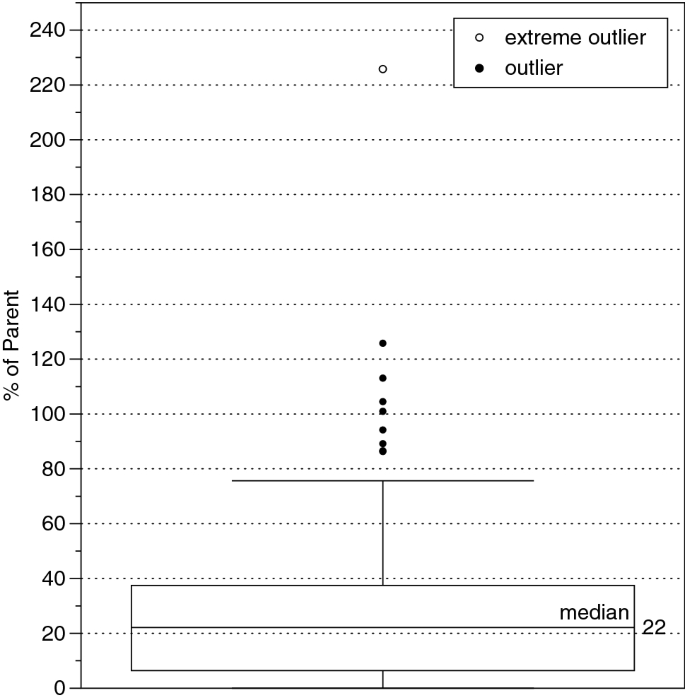

Group Subsidiaries Tax Minimization And Offshore Financial Centres Mapping Organizational Structures To Establish The In Betweener Advantage Springerlink

Tax Rates In Europe Doing Business International

Group Subsidiaries Tax Minimization And Offshore Financial Centres Mapping Organizational Structures To Establish The In Betweener Advantage Springerlink

Taxes Archives Traders Academy

Australian Forex Broker Makes Itself Available In New Zealand Stuff Co Nz

Group Subsidiaries Tax Minimization And Offshore Financial Centres Mapping Organizational Structures To Establish The In Betweener Advantage Springerlink

Metatrader 4 Start Trading With Spread Bets And Cfds Ig Ireland

Group Subsidiaries Tax Minimization And Offshore Financial Centres Mapping Organizational Structures To Establish The In Betweener Advantage Springerlink

Metatrader 4 Start Trading With Spread Bets And Cfds Ig Ireland

Group Subsidiaries Tax Minimization And Offshore Financial Centres Mapping Organizational Structures To Establish The In Betweener Advantage Springerlink