what is the difference between an indirect and a direct cash flow statement

The starting point under this method is the profit or loss before taxation. The indirect method is used more as a reconciliation of cash and while the direct method begins with the amount of cash received from customers the indirect method will begin with the companys net income amount.

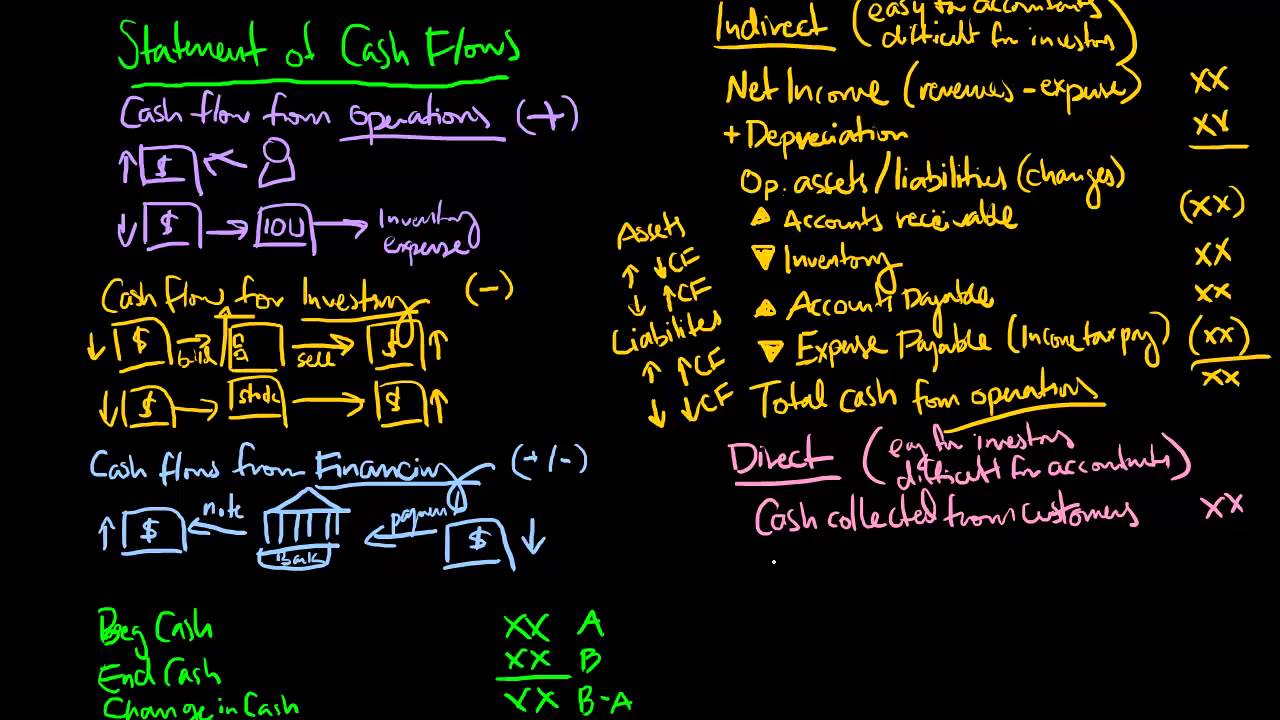

Three Types Of Cash Flow Activities Cash Flow Cash Flow Statement Positive Cash Flow

The direct method and the indirect method are alternative ways to present information in an organizations statement of cash flows.

. The key difference is that net income will be adjusted for non-cash items such as depreciation and amortization. The main difference between the direct and indirect cash flow statement is that in direct method the operating activities generally report cash payments and cash receipts happening across the business whereas for the indirect method of cash flow statement asset changes and liabilities changes are adjusted to the net. Companies applying the Direct method disclose major classes of gross cash receipts and cash payments.

Whereas the direct method will only focus on the cash transactions and produces the flow from the operations of your business. For example if a retailer sells an item on credit the indirect method will consider this as income and reflect this in the figures whereas the direct method wont include it until the bill has been paid. What is the indirect cash flow method.

The primary distinction between the direct and indirect cash flow statements is that operating activities generally report cash payments and cash receipts occurring throughout the business in the direct method. The indirect method of creating a statement of cash flow entails using changes in your balance sheet accounts to calculate cash flow from operating activities. The information from the operating activities is presented differently with each method.

Here is a link to an example of statement of cashflows presented under direct method. Manages debt easier with quick cash inflows and outflows information. Its also important to note that the accuracy of the indirect method is slightly less than the direct method.

This then identifies your. As a result you can see a summary of all cash transactions that the firm. While the indirect method uses net income as its starting point and the accrual basis of accounting the direct.

A cash flow statement is a very important financial report that helps determine your businesss success. Difference between indirect and direct cash flow. Benefits of Direct Cash Forecasting.

In contrast asset and liability changes in the indirect method are adjusted to net income to derive cash flow from operating activities. Balance sheet income statement and statement of cash flowsAccording to Dan Fletcher CFO of MarkLogic Its useful from a very high level to understand the operational financial and investing cash flows. The statement shows how changes in balance sheet accounts and income affect cash allowing you to see cash flowing in and out of your businessHowever before you start creating a cash flow statement you must decide how to record cash flows from operating.

The indirect method on the other hand focuses on net income and may include cash that is not yet in the business. As the name suggests cash flows from operating activities is presented in an indirect manner. Here youll be estimating how depreciation.

Changes in asset and liability accounts that are capable of affecting your cash balances in a defined reporting period are added or subtracted from your net income at the beginning of the period. Direct Cash Flow Statement. Works closely with banks for balancecredit management.

There are no differences in the cash flows from investing activities andor the. Cash Flow Statement Indirect Method. When most people talk about cash flow forecasting theyre referring to the indirect method which is derived from your three quarter-end financial statements.

The difference between these methods lies in the presentation of information within the cash flows from operating activities section of the statement. The indirect cash forecasting model is a little different. Additionally the indirect method will add.

As you can see there are a few key differences between direct and indirect cash flow methods. The main difference between the direct method and the indirect method of presenting the statement of cash flows SCF involves the cash flows from operating activities. This profit or loss is adjusted for the effects of transactions of a noncash nature and.

There are no presentation differences between the methods in the other two. Once youve made these adjustments the net result will be your closing bank position at the bottom. This is because it uses adjustments where the direct method does not.

What Is Indirect Cash Flow Forecasting. They are commonly known as Direct and Indirect methods. When it comes to cash flows from operations the standards allow us to choose between two distinct approaches.

You take net profit and adjust this figure for non-cash transactions. The indirect cash flow method starts with a line from a completely different report the profit loss statement. Under the direct method the statement of cash flows reports net cash flow from operating activities as major classes of operating cash receipts eg cash collected from customers and cash received from interest and dividends and cash disbursements eg cash paid to suppliers for goods to employees for services to creditors for interest and to government authorities for.

The Essential Guide To Direct And Indirect Cash Flow Cash Flow Cash Flow Statement Flow

Cash Flow Ratios Calculator Double Entry Bookkeeping Cash Flow Statement Cash Flow Learn Accounting

Cash Flow Statement Template Download Excel Sheet Cash Flow Statement Cash Flow Statement Template

Free Cash Flow Statement Templates Smartsheet Cash Flow Statement Excel Spreadsheets Templates Spreadsheet Template

Methods For Preparing The Statement Of Cash Flows Cash Flow Cash Flow Statement Accounting Basics

Statement Of Cash Flows Significant Non Cash Activities Bookkeeping Business Accounting Classes Cash Flow Statement

What Is Cash Flow And How Can You Effectively Manage It Bench Accounting Cash Flow Cash Flow Statement Accounts Payable

Direct And Indirect Cash Flow Statement Comparison Cash Flow Statement Cash Flow Positive Cash Flow

Best Cash Flow Statement Templates In Pdf Excel Word Besty Templates Cash Flow Statement Statement Template Cash Flow

Statement Of Cash Flows Explained Cash Flow Accounting Classes Easy Cash

Cash Flow Statement Indirect Method

Two Methods Are Available To Prepare A Statement Of Cash Flows The Indirect And Direct Methods The Financial Accounting St Cash Flow Statement Cash Flow Flow

Statement Of Cash Flows Indirect Accounting Cpa Exam Cash Flow

The Essential Guide To Direct And Indirect Cash Flow Cash Flow Statement Cash Flow Accounting Basics

Debit And Credit Cheat Sheet Making Of Cash Flow Statement With Both Direct And Indirect Methods Accounting Bookkeeping Business Accounting Classes

Cash Flow Statement Definition Example And Complete Guide Fourweekmba Cash Flow Statement Budgeting Money Ideas Cash Flow

Operating Activities Section By Direct Method Accounting For Management Direct Method Method Activities

Cash Flow From Operating Activities Learn Accounting Accounting Education Cash Flow

Myeducator Business Management Degree Accounting Education Accounting Classes